Putin’s Dollar Gambit

Introduction

On the surface, the West’s sanctions appear to be crippling the Russian economy and the ability of Putin to wage war in Ukraine. Although it was an almost predetermined certainty that the West would place sanctions on Russia pending an invasion of Ukraine, we must now determine what strategic options remain for Putin. There are reasonable assumptions which must be respected within the analysis of this conflict: Putin has proven himself to be a cunning and capable strategist in the past, and Putin predicted the West to place sanctions on Russia. However, could these sanctions be more devastating than he predicted? And, does he really not have a plan to counter this move? Economically, it now appears nearly suicidal for Putin to continue his campaign in Ukraine. Could there be something missing from the current mainstream assessment? Could Putin have a strategy to use the current sanctions and Western response to his advantage?

With the ongoing complexity of the war in Ukraine and the tragedy that is now certain for both Ukrainian and Russian civilian populations, geopolitically there are only several perceivable outcomes. It is important to note that while these outcomes have very different probabilities in becoming reality, they also have very different levels of risk in terms of severity. For example, it is the highest probability that Western sanctions will have a crippling effect on the Russian economy and thus the ability of Russia to wage war. This provides a low severity risk for the future outlook of the Ukraine conflict as Russia dwindles and eventually capitulates (a best case scenario). The scenario this paper suggests is the possibility in which the opposite comes to pass; Putin has calculated the risk of sanctions, has determined a plan to use the limited strength of his economy, coupled with the relative weakness of the Western based economic system, to level a death blow to the U.S. Dollar and it’s hegemony. This scenario has a very low probability of becoming a reality but would entail the highest level of severity. This paper provides a brief overview of the arguments and potentialities of this scenario, which although unlikely, may be the only chance Putin has to not only survive the conflict in Ukraine, but to actually win the greater general conflict now growing between the East and the West.

Gold’s Forgotten History

“Who controls the money, can control the world,” said Henry Kissinger in 1973, the same year that the U.S. Dollar was de-coupled from the “gold standard” and replaced by the “petro-dollar” standard.1 Since the end of WWII and the establishment of the Bretton Woods Agreement, the U.S. Dollar has functioned as the world’s reserve currency.2 It carries this responsibility through a variety of complex systems and institutions which allows for significant influence on global economics and politics. The U.S. Dollar is the foundation of U.S. hegemony and the unipolar world of the late 20th century.3 For good or for bad, the Dollar is the most fundamental tool of governance within this hegemon and is America’s greatest weapon of influence and control.

As the clear intention of Russia is to function outside of U.S. and Western institutional control, the Dollar must be targeted as the main impediment to their offensive strategies.4 In a world of historically unprecedented debt denominated in U.S. Dollars, and a worldwide monetary system that is so complex it is beyond comprehension for most, the Dollar is at its most vulnerable moment to outside attack and influence. These observations coincide with other unprecedented strategies within the Russian economy such as significantly decreasing their U.S. Treasury holdings and aggressively increasing their gold reserves.5

What role does the U.S. Dollar and economic warfare play in the current conflict with Russia? Viewing the issue through a monetary lens could be useful and significant in explaining current actions and motives in the highly complex current standoff between Russia and the West. Although the destabilization of the Dollar is improbable, the severe impact of a U.S. Dollar collapse would cause incredible fracturing of Western influence and democratic institutions.6 If this objective is part of Putin’s calculous in the invasion of Ukraine, it is vitally important to the Western world and democratic institutions that we examine the economic battlefield as equally important to the ongoing kinetic war in Ukraine.

The Greatest Tool of Governance

The U.S. Dollar is the primary method of control and power used by the United States and its institutions.7 Through sanctions, trade deals, and regulation, the U.S. is able to overwhelm adversaries and persuade allies through economic means.8 This has been the primary and most effective tool of U.S. governance and hegemony since the end of the Second World War and the formation of the Bretton Woods Agreement in 1944.9 Since the United States was the primary industrial capacity for the entire Allied war machine, vast amounts of the allied countries savings were paid to the U.S. in the form of gold, in exchange for war supplies. According to the Federal Reserve Bank, in 1947 the U.S. held in its possession approximately 55% of the entire world’s physical gold in its possession.10 This extreme imbalance of global wealth at the end of WWII allowed the U.S. to largely dictate terms of currency exchange during the Bretton Woods agreement, and put the U.S. Dollar in an unparalleled position of power in relation to the majority of allied nations who were just beginning to recover from the destruction of WWII. The Bretton Woods institutions (BWIs), the International Monetary Fund (IMF), and the World Bank were thus established with the objective of all foreign currencies to be denominated by the U.S. Dollar. The Dollar itself would then be pegged by a gold equivalency of $35USD to one ounce of gold held in U.S. depositories. This financial and economic hegemony was the foundation for U.S. led Western institutions since the end of WWII.11

The Bretton Woods system collapsed in 1973 as foreign currencies and their corresponding national leadership feared that the U.S. Dollar had over issued notes (credit) and did not have the equivalent gold in its depositories to meet the $35USD per ounce standard.12 It appears to be true, although unconfirmed, that the United States did not have the corresponding reserves of gold. The U.S. President at that time, Richard Nixon, declared a suspension of the U.S. Dollars price pegged to gold.13 This allowed the Dollar and all other currencies to derive their value from any other market forces. From that point forward, the U.S. Dollar would be, and still is, pegged, in general, to the price of oil.14 By means of direct agreements between Saudi Arabia and the United States, as well as other oil producing countries, the Dollar would derive its value from the demands of global oil sales. Generally, these oil producing countries agree to sell all their oil exports priced in U.S. Dollars, which is now known as the petrodollar. The petrodollar allowed the U.S. Dollar to rise even further to a level of dominance making it the world’s reserve currency through massive trade deficits in its favor and oil products as the world’s primary energy source. The control of this petrodollar system is the main tool of governance used by the U.S. and its institutions since the collapse of the gold standard.15

Russia’s Smothered Ambitions

Putin sees the U.S. and its institutions such as NATO, the IMF, and the World Bank as a direct existential threat to his regimes existence.16 As the clear trend for democratic institutions has been pushing eastward, incorporating more and more territory directly up to the borders of “Red Flag” nations such as Russia and China, these countries fear that they will be targeted by the western institutions themselves, or by their own populations seeking to possess liberal and democratic freedoms.17 This is the clear and outspoken claim of Russian leadership, beginning with Putin’s famous speech at the Munich Security Conference in 2007, to the overt claims of Western aggression in his national address prior to the invasion of Ukraine.18 19

Since Russia views the motivation of Western institutions with these strategies at the forefront of their actions, they would logically scheme defensive and offensive strategies against the weapons most effective and threatening to them. According to senior Russian authorities within the political and military establishment, the U.S. Dollar poses the highest risk to Russia’s survival. It is thus the ultimate target of countries such as Russia and China who wish to subvert the control of Western institutions. This sentiment can be clearly felt in Yevgeny Fyodory's recent interview who is the Chairman of the Committee on Economic Policy of the State Duma (Russia):20

“The dollar requires worldwide jurisdiction – Anglo-Saxon law – because currency is worthless if it’s not supported by juridical system. Hence comes the mechanism of the world jurisdiction, the unipolar world as a vertical authority. According to Putin, “one power center means one decision-making center”. What’s Russia’s interest? To restore the ruble, which will allow Russia to immediately control 6% of the world currency turnover. And I’d like to remind you that at present we control only 0.18%. In the long run, taking into account that Russia has 1\3 of the world’s resources, we expect this figure to reach 1\3 of the world turnover. We want to have the right to print out currency.”

The Weaponized Dollar

One of the most transparent tools of governance the U.S. Dollar provides is through sanctions. Sanctions are economic restrictions (i.e., punishments) made possible due to the status of the U.S. Dollar as the world’s reserve currency.22 Since the U.S. Dollar is used as the primary trading currency of all nations worldwide (global reserve currency), the U.S. can block payments routed through the U.S. banking system and partner systems and also freeze assets in a variety of different methods. In this way, the U.S. does not have to take kinetic action directly against Russia at all, but merely compel some of Russia’s largest trading partners to scale down or cancel purchases of Russian exports. This tactic in combination with seizing or freezing Russian assets held within the U.S. banking system essentially creates an economic siege of Russia.23 Due to the interdependence of the global economy, this act would severely limit Russia’s ability to wage war by decreasing their opportunity to buy and sell fuel, food, and any other required material that is not produced on Russian soil. Sanctions not only decrease the opportunity to trade, but also decrease the purchasing power of the Ruble, making it more costly to buy items in the limited markets that are still available. In summary, sanctions levied by the U.S. Dollar in a globally connected economy limit what Russia can purchase, and how much they can purchase. This has been a primary tool of U.S. governance around the world since WWII, utilized by almost every U.S. President against nations and leaders they wished to influence or destroy.24

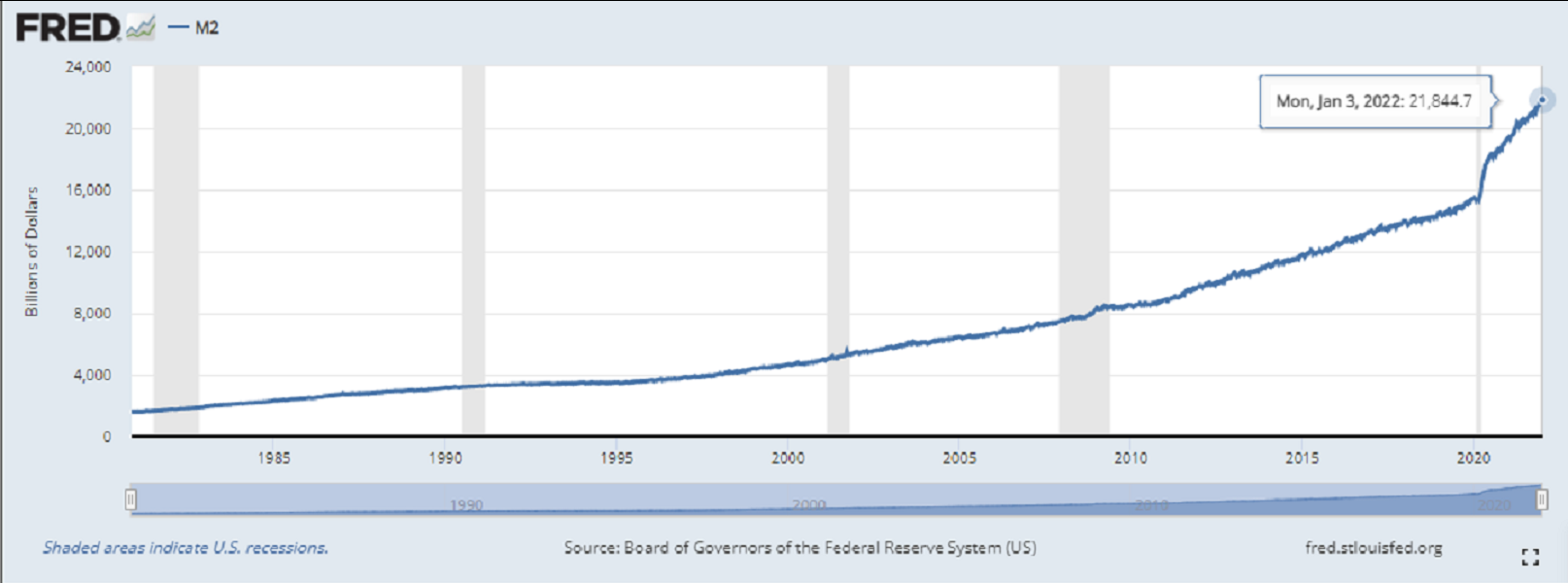

There are many other unique and powerful ways that the U.S. and Western institutions can use the U.S. Dollar as the world’s reserve currency as an offensive weapon. Potentially the most important way is through U.S. Dollar devaluation.25 Since many foreign currencies, treasuries, and commodities are pegged to the Dollar, the U.S. Government can hold significant control over them through currency creation. For example, when the United States is in need of increased production of money, or increased economic activity, for any number of political or strategic reasons, the Federal Reserve (which functions as the U.S. and the world’s central bank) can increase the supply of Dollars to meet their needs. Since the majority of foreign debt is held in U.S. treasury bonds, the U.S. government has the ability to control the value of these notes both on the side of the borrower, and the creditor. As they are the creators of the new currency, they will be able to “spend” it first. This method has been used by governments and leaders for ages; from the devaluation of coinage in ancient Athens, Turkey, and Rome, to the modern hyperinflationary events of the 20th century most widely known in Weimar Germany and Nationalist China around the same periods.26 Things are drastically different now because there has never been a fiat currency used to the global extent of the U.S. Dollar, with so much attached to it both economically and institutionally.27

The Greatest Risk Unseen

Assuming that the primary and foundational objective of Russia is to “de-dollarize,” all other Russian actions and strategies build upon this overarching objective.28 In an October 2021 interview, Vladimir Putin stated, “I believe the U.S. makes a huge mistake in using the dollar as a sanction instrument, economic weapon, we are forced, we have no other choice, but to move to transactions in other currencies.”29 This strategy of Russian de-dollarization has been implemented for at least the last decade, but much more rapidly and transparently within the last five years. This can be clearly seen in the political struggles of Russia’s main export of natural gas and oil to Europe via the Nordstream 2 pipeline.30 These motivations also tie back to the U.S. petrodollar; if the Dollar is outpriced, by a country like Russia outside of the U.S. sphere of influence, it will directly diminish the power and control the petrodollar has globally. The fear is that this could create a domino effect of countries attempting to trade outside of the petrodollar system, somewhat similar to President Eisenhower’s “Domino Theory” of the Cold War.31 This theory could make sense as developing nations seek to subvert the control Western institutions hold over them.

The main concern of Russia is the power the Dollar has as a world reserve currency in its ability to devalue. Devaluation allows the U.S. to purchase/import tangible commodities with credit in the form of U.S. treasuries. These treasuries can then be devalued through the creation of new U.S. Dollar denominated currency within programs such as “Quantitative Easing” and other forms of government spending. Furthermore, the devaluation of the U.S. Dollar has impacted the purchasing power of weaker currencies like the Russian Ruble, and most recently the Turkish Lira, where much more significant inflation is taking place due to its denomination in U.S. Dollars.32 Russian leadership knows that in order to accomplish any of its plans and strategies it must first undermine the power that the U.S. Dollars has.

Why Gold?

Russia seeks to increase its gold reserves for the same reason that the United States backed the Dollar with gold at the end of the Second World War in the Bretton Woods agreement. Gold has a history of over 5,000 years of monetary usage that has stood the test of time through economic and political regimes of many different forms.33 In other words, gold is the safe bet, especially for a country like Russia that is dependent almost exclusively on commodity exports for its gross domestic product. It is potentially one of the only sure methods of maintaining value amidst the devaluation of the U.S. Dollar and historically unparalleled levels of global debt.34

If the U.S. Dollar were to collapse, the populations of the world would lose trust in the value of the Dollar in terms of its purchasing power and the U.S. would lose this significant tool of influence. In the scenario of a U.S. Dollar collapse, the most likely outcome would be to install a new monetary regime or a variety of regimes based on tangible commodities. Gold, being of the highest value commodity and with the longest record, could fulfill this mandate. At the very least, Russia could be hedging its bet against the potentiality of a U.S. Dollar collapse or could actually be planning an attack with its Cyber Warfare capabilities.35 In the recent past, many vulnerabilities have been discovered in the highly complex and digitalized system the U.S. Dollar has created. Some systems such as the New York Stock Exchange are run mostly through complex algorithms that are not completely understood.36 This complexity, not only in the Stock Market, but more broadly speaking in the global economy, creates a huge vulnerability for the U.S. and its institutions.37 The disturbing conclusion is that the Dollar is unstable and vulnerable to any number of “black swan” events or attacks that could lead to failure. There is a distinct correlation between the post WWII institutions of the West becoming less unified, less effective, and overall weaker, and the U.S. Dollar becoming less of an effective ruler of the world economy.

“There is a widespread assumption that the West is playing from financial strength into Russian weakness. This is not so. The Western economic system is in a deepening crisis of its own. Accelerated currency debasement is feeding into rising prices as purchasing powers decline. At the same time, the artificial economic boost from economic and currency interventions is fading. Some say its stagflation. But a better description is that the West’s problems stem from monetary inflation and increasing market awareness of the hidden taxation by negative real yields on government bonds. Central banks have enough of a dilemma dealing with the fall-out from their monetary policies without seeing an acceleration of financial hostilities against anyone.”38

Putin’s Gambit

A Gambit is an opening move in Chess in which a player risks one or more pawns or a minor piece in order to gain an advantage in position. The invasion of Ukraine could be a type of gambit strategy whereby Putin sacrifices his own economy in order to destroy the Western economies simultaneously through spending and refugee crisis response. Sanctions from the U.S. dollar on a peer competitor will not be the same as on a backwater country such as Afghanistan, Iran, or North Korea. Within the global interconnected economy, such a global supply disruption from a country as large as Russia, which produces significant amounts of the worlds required commodities, will cause pain within the western world as well.39 We can hope that western leaders understand this and have calculated the risk to reward ratio of this gambit. However, with the U.S. and European Stock Markets in decline, as well as a U.S. and Euro Dollar inflation rate at the highest in 30 years, there is a significantly increased risk of currency/economic failure at this time.40 This could be a main driver in Putin’s calculous to invade Ukraine at this specific moment. Perhaps the war in Ukraine could solve two problems for Putin at the same time. First, it could secure Russia’s border and stop the progress eastward of NATO and Western Institutions. Second, it could serve as an opportunity to force developing nations playing the middle ground to choose sides within the coming and inevitable confrontation of the East and West. If Putin can force the U.S. and its institutions to overstep and subvert the autonomy of other nations through sanctions, some of these nations may see a chance to break from U.S. Dollar hegemony. Nations like Russia and China wishing to uphold their autocracies and dictatorships have witnessed the U.S. led assassinations of Saddam, Gaddafi, and Soleimani. The east may feel this is their best, or only chance at survival. The west and its institutions need to be aware of this. Publicly, at least, they do not appear to grasp the severity of the situation.

Conclusion

Russia knows that to gain its sovereignty and evade U.S. hegemony it must destroy the U.S. Dollar. This destruction is the stated objective of Russia and its allies consistently maintained through decades of strategic development and political turnover within their establishments. This fact alone should cause political and military decision-makers in the United States and the west to be concerned about a major attack. To add to this great risk, the Dollar is indisputably less stable than it was at any other point in its relatively short history, and U.S. denominated debt is at the highest levels it has ever been. With massive trade deficits, the United States has also created more currency within the last five years than it has in the previous 200 years of the Dollar’s existence, creating a devaluation of the Dollar of more than 95%.41 Russia may not have to commit a major attack or act of warfare, but simply give small pushes in specific areas that create a cascading effect of destabilization and eventually decreased trust in the power of the U.S. Dollar. The Ukraine conflict could, in effect, be this push within the global economy. By creating a domino effect of taking sides and economic warfare, it increases the vulnerability and weakness in the U.S. Dollar. At the very least it is important to remember what the French economist Frederic Bastiat said, “When goods do not cross borders, Soldiers will.”42

Special Thanks to Dr. Graeme Herd, CDR Joshua Hensley, Dr. Karen Finkenbinder, and Missy Odom for their assistance in research and editing.

Notes

1 Henry Kissinger, “Henry Kissinger Biography". https://www.biography.com/political-figure/henry-kissinger, Accessed November 23, 2021.

2 Pisani-Ferry, Jean and Adam S. Posen, eds., The Euro at Ten: The Next Global Currency (United States of America: Peter G. Peterson Institute for International Economies & Brueggel, 2009).

3 Schenk, Catherine R. “The Retirement of Sterling as a Reserve Currency after 1945: Lessons for the US Dollar?,” Canadian Network for Economic History conference, October 2009.

4 Ambrosio, Thomas. Challenging America's Global Preeminence: Russia's Quest for Multipolarity (London: Routledge, 2005).

5 Doff, Natasha. “Russia now holds more gold than Dollars,” Bloomberg, January 12, 2021. https://www.bloomberg.com/news/articles/2021-01-12/russia-s-583-billion-reserves-now-hold-more-gold-than-dollars

6 Ross, Sean. “What It Would Take for the U.S. Dollar to Collapse,” Investopedia, June 18, 2021. https://www.investopedia.com/articles/forex-currencies/091416/what-would-it-take-us-dollar-collapse.asp.

7 Gordon, Joy. “Sanctions as Siege Warfare,” The Nation, March 4 1999, https://www.thenation.com/article/archive/sanctions-siege-warfare/.

8 Bertaut, Carol, Bastian von Beschwitz, and Stephanie Curcuru, “The International Role of the U.S. Dollar,” FEDS Notes, Board of Governors of the Federal Reserve System October 06, 2021, https://www.federalreserve.gov/econres/notes/feds-notes/the-international-role-of-the-u-s-dollar-20211006.htm

9 Bernstein, Edward. “Reflections on Bretton Woods.” In The International Monetary System: Forty Years After Bretton Woods, 15-20. Boston: Federal Reserve Bank of Boston, May 1984.

10 Bordo, Michael D. "Gold Standard." In The Concise Encyclopedia of Economics. Library of Economics and Liberty, 2008,, https://www.econlib.org

11 Francis J. Gavin, Gold, Dollars, and Power – The Politics of International Monetary Relations, 1958–1971, (Chapel Hill: The University of North Carolina Press, 2003).

12 International Monetary Fund (IMF), “The End of the Bretton Woods System,” March 2022. https://www.imf.org/external/about/histend.htm

13 International Monetary Fund (IMF), "Money Matters: An IMF Exhibit – The Importance of Global Cooperation – The Incredible Shrinking Gold Supply". International Monetary Fund. Accessed March 8, 2022.

14 This is a simplification for the purpose of the argument but generally holds true.

15 Amadeo, Kimberly. "Petrodollar and the system that created it". The Balance. https://www.thebalance.com/what-is-a-petrodollar-3306358, Accessed October 19, 2021.

16 Speech of Robert M. Gates, Munich Conference on Security Policy, Germany, February 11, 2007. Münchner "Sicherheitskonferenz" 2007: Robert M. Gates, 12.02.2007 (Friedensratschlag) (ag-friedensforschung.de)

17 German, Tracy. "NATO and the enlargement debate: enhancing Euro-Atlantic security or inciting confrontation?" International Affairs 93.2 (2017): 291–308.

18 Al Jazeera Staff, “Putin's Speech declaring war on Ukraine” Aljazeera, March 17, 2022. https://www.aljazeera.com/news/2022/2/24/putins-speech-declaring-war-on-ukraine-translated-excerpts.

19 Kupiecki, Robert and Marek Menkiszak. "Speech and Q&A of the President of the Russian Federation Vladimir PUtin at the Security Policy Conference in Munich, February 10, 2007," Documents Talk: NATO-Russia Relations After the Cold War. (Warsaw: Polish Institute of International Affairs, 2020). p. 375.

20 Tétrault-Farber, Gabrielle and Darya Korsunskaya, "Russia to cut share of U.S. dollar in National Wealth Fund, mulls other currencies". Reuters. November 13, 2019.

21 Landesman, Nash. "Is the Other Side of the Story Russia's View on Geopolotics, War, and Energy Racketeering?" SakerBlog, March 2022, https://thesaker.is/the-other-side-of-the-story-russias-view-on-geopolitics-war-and-energy-racketeering/.

22 United States Department of the Treasury. "Sanctions Programs and Country Information". Accessed March 13, 2022.

23 Congressional Research Service, "Venezuela: Overview of U.S. Sanctions". Federation of American Scientists. March 8, 2022.

24 Elliott, Kimberly Ann, "Evidence on the Costs and Benefits of Economic Sanctions." Peterson Institute for International Economics, 3 March 2022.

25 Harris, Craig and Matthew Brown, "How Sanctions will Impact Ordinary Russian's" USA Today, March 3, 2022, https://eu.usatoday.com/story/money/2022/03/01/sanctions-russia-economy-ruble-interest-rates/9319775002/

26 Cagan, Phillip. "The Monetary Dynamics of Hyperinflation," in Milton Friedman (Ed.), Studies in the Quantity Theory of Money, (Chicago: University of Chicago Press,1956) March 2, 2022.

27 Economist Intelligence Unit, "The World Debt Clock Economist," The Economist, March 4, 2022, https://www.economist.com/content/global_debt_clock

28 Friedman, Milton. (1987). "Quantity Theory of Money", The New Palgrave: A Dictionary of Economics, 4th Ed., March 3, 2022, 15–19.

29 Turak, Natasha, "Russia's central bank governor touts Moscow alternative to SWIFT transfer system as protection from US sanctions". CNBC. Accessed March 3, 2022.

30 Arquilla J, "SMA TRADOC White Paper- Russian Strategic Intentions," NSI, March 2, 2022. https://nsiteam.com/sma-white-paper-russian-strategic-intentions/

31 Marsh, Sarah and Madeline Chambers, "Germany's Scholz halts Nord Stream 2 as Ukraine crisis deepens". Reuters. February 22, 2022.

32 Leeson, Peter T.; Dean, Andrea. "The Democratic Domino Theory". American Journal of Political Science. 53 (3), 2009. 533–551.

33 Ertem, Cemil. "IMF backed by terrorists has failed in Turkey – adviser". Ahval. Accessed January 30, 2022.

34 Duckenfield, Mark. "The Monetary History of Gold: A Documentary History, 1660–1999." (London: Routledge, 2004).

35 Spencer, Roger W. "Inflation, Unemployment, and Hayek". Federal Reserve Bank of St. Louis. May 1975.

36 Defense Intelligence Agency, "Russian Military Power Report," DIA, March 10, 2022. https://www.dia.mil/Portals/110/Images/News/Military_Powers_Publications/Russia_Military_Power_Report_2017.pdf

37 Harold, James. The End of Globalization: Lessons from the Great Depression. (Cambridge, MA: Harvard University Press, 2001).

38 World Bank, "Economic outlook," World Bank, March 3, 2022, https://www.worldbank.org/en/news/feature/2020/06/08/the-global-economic-outlook-during-the-covid-19-pandemic-a-changed-world.

39 Macleod, Alisdair. "This Could Take the Dollar Down," Zero Hedge, March 2, 2022, https://www.zerohedge.com/markets/could-take-dollar-down-alasdair-macleod-warns-theres-real-crisis-winds.

40 Economist Staff, "Western Sanctions on Russia are like none the world has seen," The Economist, March 5, 2022, https://www.economist.com/briefing/2022/03/05/western-sanctions-on-russia-are-like-none-the-world-has-seen

41 Kemp, John. "Western economies on brink of recession as Russia sanctions escalate," Reuters, March 6, 2022. https://www.reuters.com/markets/europe/western-economies-brink-recession-russia-sanctions-escalate-kemp-2022-03-08/.

42 Wright, Robert E. One Nation Under Debt: Hamilton, Jefferson, and the History of What We Owe. (New York: McGraw-Hill, 2008).

43 Snow, Nicolas. "If goods don't Cross Borders," Foundation for Economic Education (FEE), October 26, 2010, https://fee.org/resources/if-goods-dont-cross-borders/

About the Author

Westin Reuter is a GCMC alumnus and works at the GCMC in the publications and editing department. He graduated from Montana State University with a BA in History. He served as a U.S. Army officer and after leaving the military, Westin worked as a Country Security Manager for Samaritan's Purse, a disaster relief organization. His non-governmental work took him to Haiti, East Africa, Iraq, and Syria. He received a Masters in International Security Studies from Bundeswehr University, Munich where his research focused on the positive and negative consequences of increased government influence in the NGO sector.

The George C. Marshall European Center for Security Studies

The George C. Marshall European Center for Security Studies in Garmisch-Partenkirchen, Germany is a German-American partnership and trusted global network promoting common values and advancing collaborative geostrategic solutions. The Marshall Center’s mission to educate, engage, and empower security partners to collectively affect regional, transnational, and global challenges is achieved through programs designed to promote peaceful, whole of government approaches to address today’s most pressing security challenges. Since its creation in 1992, the Marshall Center’s alumni network has grown to include over 15,000 professionals from 157 countries. More information on the Marshall Center can be found online at www.marshallcenter.org.

The articles in the Perspectives series reflect the views of the authors and are not necessarily the official policy of the United States Army, the United States, Germany, or any other governments.